Professionelle Landtechnik aus Marxen und Soltau

Wir sind die Landtechnik Spezialisten mit Know-How und Improvisationstalent.

John Deere Landtechnik und Technologie

- John Deere

- Landtechnik

Wir sind langjähriger Vertragspartner und Spezialist für grüngelbe Landtechnik.

Kramer Rad- und Teleskoplader

- Kramer

- Radlader

- Teleskoplader

Innovative und leistungsstarke Radlader, Teleskopradlader und Teleskoplader für die Landwirtschaft.

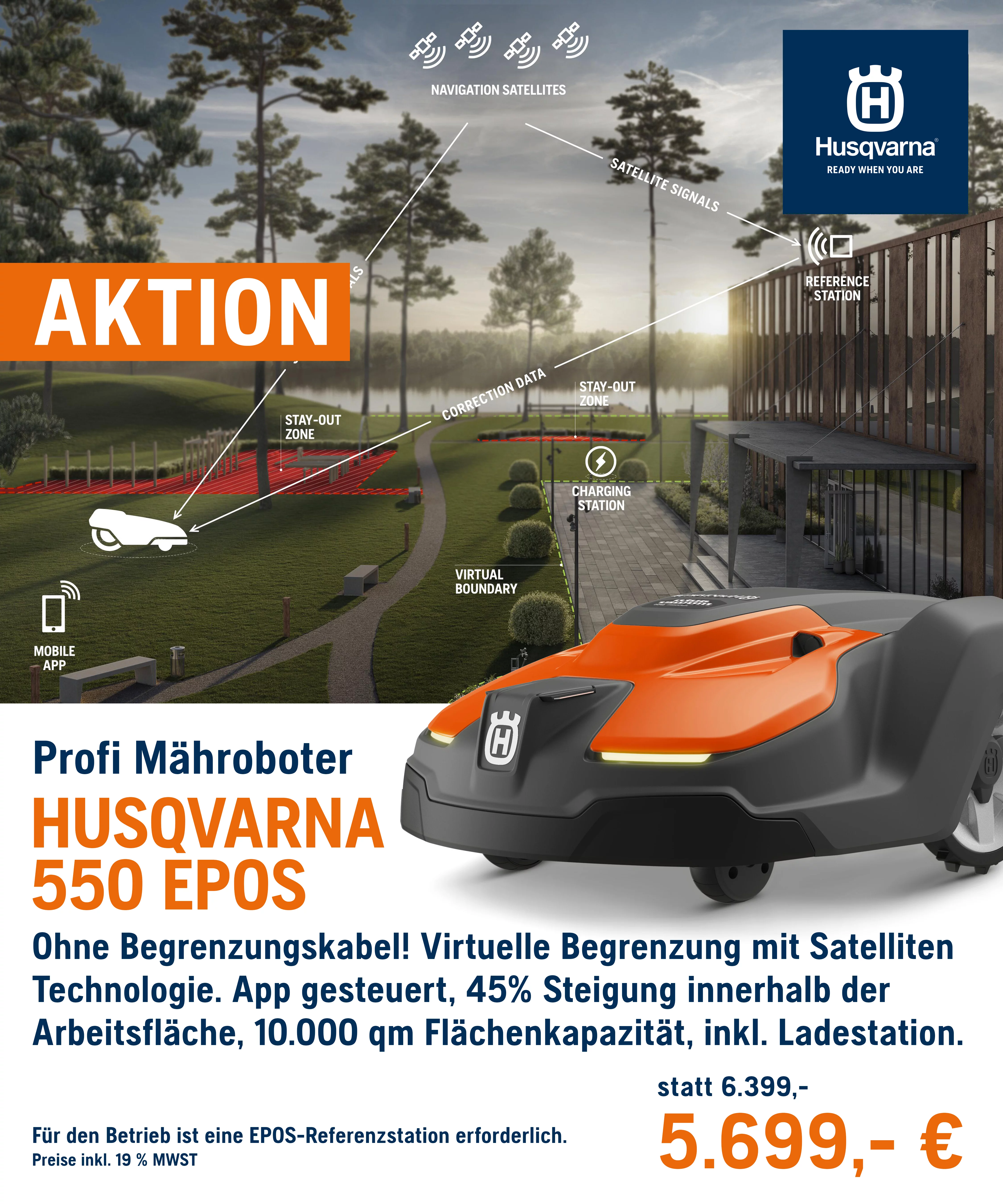

Rasen- und Grundstückspflege

- Husqvarna

- Automower

Als langjähriger Husqvarna Automower® Experte kommen wir gerne zur Beratung in Ihren Garten und kümmern uns um die fachmännische Installation.

Neumaschinen ab

0,0 % finanzieren

- Kuhn

- Finanzierung 0%

Sichern Sie sich jetzt Neumaschinen zu Sonderkonditionen und besten Finanzierungsan...

Jobs und Zukunft

- Stellenangebote

- Marxen

- Soltau

Wir bieten Teamarbeit, Entwicklungsmöglichkeiten und das Arbeiten mit neuester Technologie.

Aktuelles

Mit unseren aktuellen Angeboten sparen Sie Zeit und Geld. Besuchen Sie uns vor Ort. Wir beraten Sie gerne.

Gebrauchtmaschinen

Finden Sie Ihre Maschine in unserem Gebrauchtmaschinenportal und an unseren Standorten. Nehmen Sie für eine Vorführung Kontakt mit uns auf.

- John Deere

- Expert Check

- Traktor

Expert Check

Bringen Sie Ihren Traktor zu unserer kostengünstigen, umfassenden technischen Überprüfung und bereiten Sie ihn so auf zukünftige Aufgaben vor. Wenn Sie mehrere Maschinen checken lassen, profitieren Sie von attraktiven Sparangeboten.

- John Deere

- Expert Check

- Erntemaschine

Nach der Ernte ist vor der Ernte

Mit unserem Nachernte Expert Check machen Sie Ihre Mähdrescher, Feldhäcksler, Presse und Spritze wieder rundum fit für die kommende Saison und sichern sich unsere Erntegarantie.

Wir übernehmen Verantwortung

Wir führen das Familienunternehmen mittlerweile in der dritten Generation und setzen uns mit handwerklichem Geschick, technischem Verständnis, ehrlicher Beratung und der nötigen Geduld dafür ein, dass unsere Landwirte ihre große Verantwortung für die Produktion von Lebensmitteln wahrnehmen können.

Seit über 90 Jahren unterstützen wir die Landwirte in unserer Umgebung dabei, ihre Felder zu pflügen, die Saat auszubringen und ihre Ernte einzuholen.

1931 eröffnete mein Großvater Erich Schlichting seine Schmiede am Dorfeingang von Marxen. Pferde wurden beschlagen, Geräte für die Feldarbeit angefertigt und instand gesetzt. Damals kochte seine Frau Frieda noch für alle Mitarbeiter ein Mittagessen und kümmerte sich um die Tankstelle. In den 60er-Jahren übernahmen meine Eltern den Betrieb und spezialisierten sich auf den Verkauf und die Reparatur von Landmaschinen und Zubehör. Seit 1974 ist unsere Firma eine John Deere Vertretung.

Kompetente Ansprechpartner

Alle unsere Verkäufer haben persönlichen Bezug zur Landwirtschaft und können professionell und ehrlich beraten. Unser speziell geschultes Kleingeräte-Team unterstützt Sie sachkundig bei der Gartengeräteauswahl.

Service rund um die Uhr

Jede Stunde, die eine Maschine steht, kostet dem Landwirt und Lohnunternehmer Geld und Nerven. Gut, dass wir ihm während der Saison an jedem Tag der Woche mit dem Ersatzteilservice, den Mietmaschinen und dem Notdienst zur Seite stehen.

Husqvarna Sortiment

Seit Jahren vertreten wir die professionellen Husqvarna-Produkte für Wald, Park und Garten. Die wegweisenden Innovationen des schwedischen Unternehmens vereinen Leistung und Benutzerfreundlichkeit mit Sicherheit und Umweltschutz. Für Automower® Besitzer bieten wir den Winter-Check samt Einlagerung an.

Unsere Teams in der Hauptniederlassung in Marxen und am Standort in Soltau beraten Sie gerne und freuen sich auf Ihren Besuch.

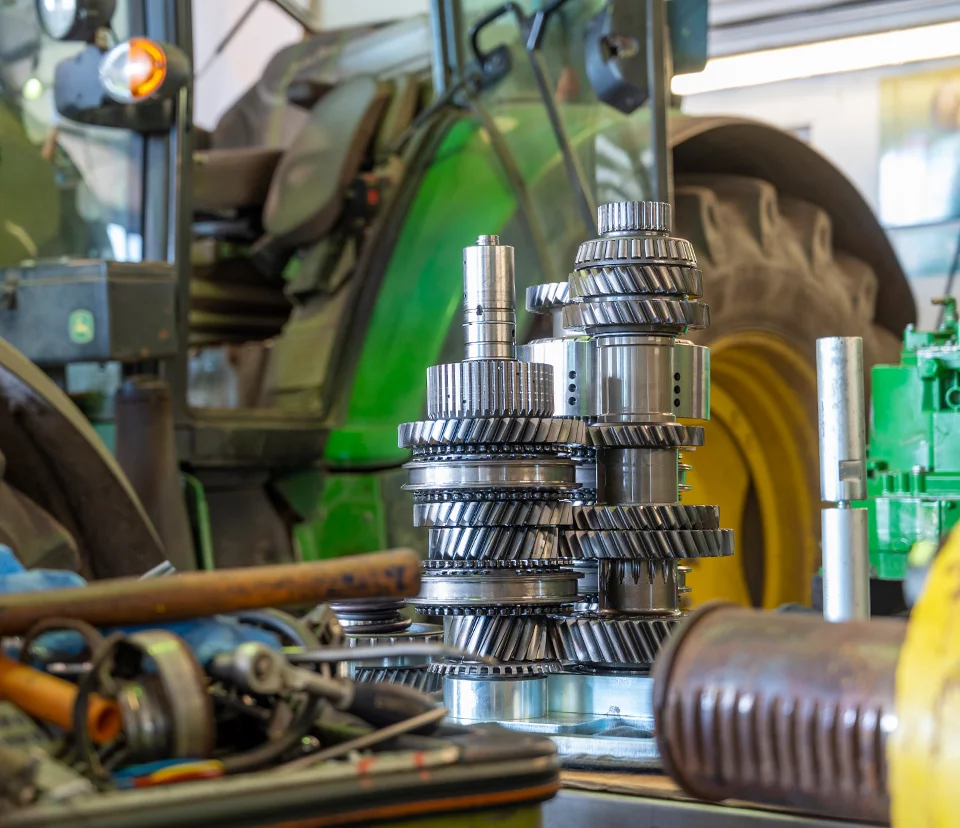

Reparatur und Werkstatt

Der Großteil unseres Service-Teams hat schon die Ausbildung erfolgreich bei uns abgeschlossen. Durch regelmäßige Teilnahme an Lehrgängen und Weiterbildungen ist unser Team stets auf dem aktuellsten technischen Stand.

Ersatzteile

Damit aus der Saat eine gute Ernte wird, müssen jeden Tag viele Räder zuverlässig ineinandergreifen. Unsere Ersatzteilmanager verfügen über mehr als 16.000 verschiedene Artikel. Und sollte ein Teil nicht vorrätig sein, ist es overnight am nächsten Morgen abholbereit.

Erntegarantie

Mit uns bleiben Sie mobil. Während der Erntesaison können wir Sie mit unserem Dienstleistungspaket verlässlich unterstützen. 24-Stunden Ersatzteillieferung, Ersatzmaschine, professionelle Schulungen, fachmännischer Support.

Marxen

Schlichting Landmaschinen

Hauptstraße 10

21439 Marxen

+49 (0)4185 - 7978 0

info@schlichting-landmaschinen.de

Mo bis Fr: 7.30 - 16.30 Uhr

Samstag: 8.00 - 12.00 Uhr

Soltau

Schlichting Landmaschinen GmbH

Am Hornberg 10

29614 Soltau

+49 (0)5191 - 9814 0

info.soltau@schlichting-landmaschinen.de

Mo bis Fr: 07.45 - 12.00 Uhr

13.00 - 16.30 Uhr

Samstag: nach Absprache